Menu

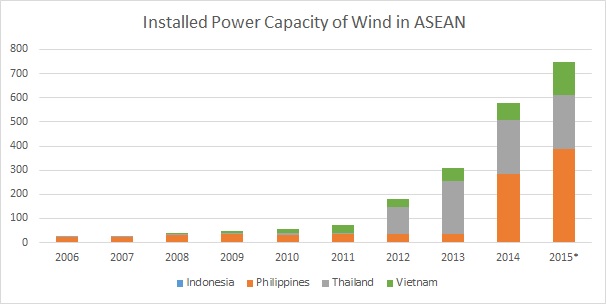

In the last decade, wind energy development in ASEAN has increased tremendously with the compound annual growth rate (CAGR) of 45.4%.

The growth rate of wind power in ASEAN is just below solar photovoltaics (PV), which have the highest growth among other renewable sources. Even though hydropower is still the biggest source of renewables in ASEAN, the development of wind power has been showing promising progress. In 2006, ASEAN only had 25 MW of wind power, mostly in pilot projects and small scales. Currently, the Philippines is the largest market for wind power in ASEAN, adding 350 MW of new capacity in 2014-2015. Cumulative wind power capacity in the region has more than tripled in the last 3 years, from 145 MW in 2012 to 750 MW in 2015.

The year 2012 was an important year for Thailand’s wind power, when the first commercial wind power commenced its operation, adding a total of 104 MW in 2013. In the meantime, for the Philippines, the development of wind was showing significant progress in 2014, with total additional capacity of 250 MW.

Commitment to Wind as a Cheaper and Cleaner Alternative Energy

The ASEAN Member States (AMS) has set an aspirational target to achieve renewable energy (RE) share of 23% by 2025. Several AMS like Thailand, the Philippines, Indonesia and Vietnam have stated their commitment to wind power by including it in their RE target. The targets of wind energy in the AMS are shown in the table below :

| Member State | Wind energy target |

| Lao PDR | 73 MW in 2025 |

| Indonesia | 1.5 GW in 2025 |

| Philippines | 2.3 GW in 2030 |

| Thailand | 3 GW in 2036 |

| Vietnam | 12 TWh in 2030 |

Wind power not only addresses the challenges of energy security, climate change and access to energy for all, but it also becomes increasingly cost-competitive. As reported by Electricity Markets & Policy Group at Lawrence Berkeley National Laboratory (Berkeley Lab), wind prices are at an all-time low, with newly built wind projects in the U.S averaging around 2¢/kWh thanks to technology advancements and cost reductions across the wind industry .

Feed-in Tariff as Key Policy

Stable and long-term policies that reduce investment/business risks are critical for RE deployment. The policies should bring confidence and security to project developers and financiers to ensure long-term implementation. Based on the ASEAN Centre for Energy (ACE)’s study on ASEAN RE policies , comprehensive RE policies that include essential tools such as attractive tariffs and incentives stimulate investment from the private sector.

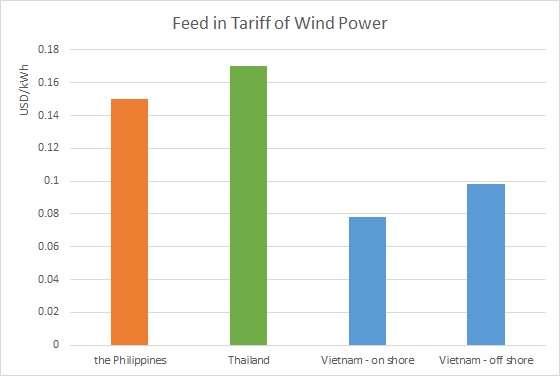

In the early stage of wind power’s deployment when investors and lenders still perceived the technical and financial risks as very high, feed-in tariffs (FiT) attracted enough interests in wind power projects. Among the AMS, only the Philippines, Thailand and Vietnam apply FiT for wind power, as shown in the figure below:

In the Philippines, there was a positive impact on wind power projects when the FiT rules and regulations for RE were promulgated in 2010 and the rates were announced in 2012. The impact could be seen in 2014 when the number of wind power projects exceeded the country’s short-term target. In the Philippines, the FiT is granted to a project once it is ready for operation.

In Thailand, only small wind turbines had been developed from 2007 to 2011. Even though the adder scheme (now FiT) was already introduced in 2007, large wind farms were developed only in 2012 and 2013. Wind power in Thailand is limited to along the gulf area where a few large wind farms have been developed.

In Vietnam, the wind power tariffs were first introduced in 2011, but it appears that it has limited impact on the development of wind power projects. During that time, the existing three wind power projects had already started their operations before the selling tariffs were applied. These days, project developers and investors think that the current FiT for wind power projects in Vietnam is low. This makes investment in wind power projects unattractive. However, the Government of Vietnam is preparing a new FiT for wind power to attract more investment.

Featured photo: 54 MW San Lorenzo wind farm in Guimaras Island, the Philippines.

References:

1. ASEAN Centre for Energy: ASEAN Renewable Energy Policies. 2016

2. https://emp.lbl.gov/publications/2015-wind-technologies-market-report . Accessed on 28 January 2016